Bankruptcy

What Is Bankruptcy? Pros and Cons of Bankruptcies UK

We could write off up to 85% of your unaffordable debt

Table of Contents

What Is Bankruptcy?

Bankruptcy is a legally binding debt solution. It is often seen as a last resort if other debt solutions fail or can’t be completed within a reasonable timeframe. It is a process whereby debt is written off.

Bankruptcy is available to residents of England, Wales and Northern Ireland, however in Scotland it is known as Sequestration.

An individual can choose to file for bankruptcy, however, in some cases your creditors can raise a petition called a Bankruptcy Order to make you bankrupt.

Being bankrupt is an extreme option that can have severe lasting consequences on your life.

Which is Easier, Going Bankrupt or IVA?

When To Choose An Iindividual Voluntary Arrangement Over Bankruptcy

- When you own a home or other asset that you don’t want to lose.

- You own your own business

- You have a job that you may lose if you go bankrupt.

- You have power of attorney or a looking to seek power of attorney for someone else.

- Have some spare income each month

- Want to avoid any social stigma attached to being made bankrupt.

Do I Qualify for Bankruptcy?

Bankruptcy should always be seen as an absolute last resort, however if you are considering it, here are some things to consider:

Does your debt exceed £5,000?

Is your debt more than the value of your assets?

Are you unable to repay your debt in a reasonable timeframe?

Do you have little or no disposable income to cover an IVA?

Are your circumstances unlikely to improve in the near future?

Which Debts Can Be Included In Bankruptcy?

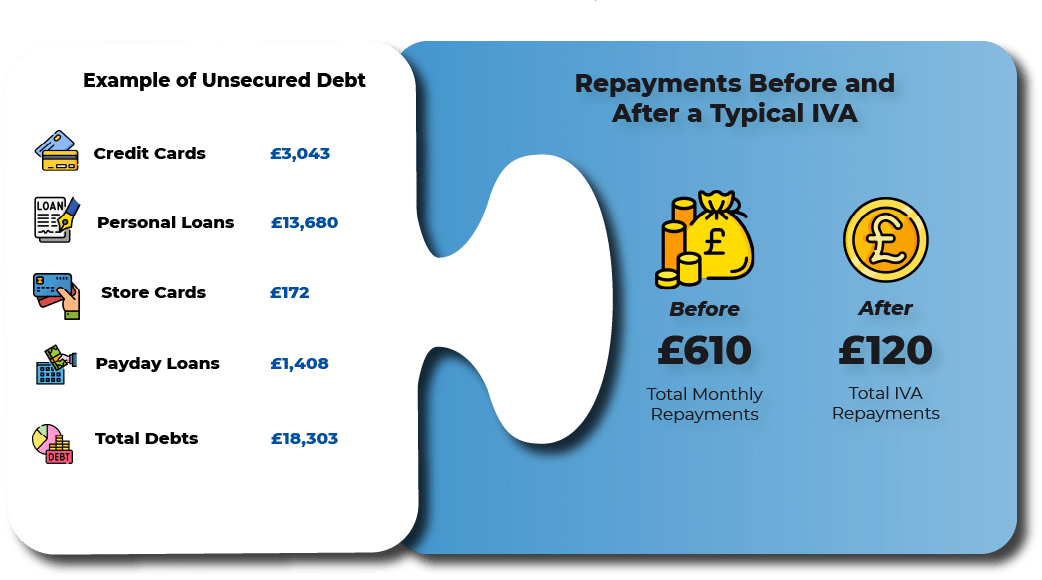

If you are being made bankrupt, then your Insolvency Practitioner will include all Unsecured Debts into your arrangment e.g. credit cards, personal loans and council tax.

How Do I Apply for Bankruptcy?

To declare yourself bankrupt, you will need to fill in an online application form. You will need to provide details of the debts you owe, how much income you have and what other outgoings you pay.

If you have been in contact with any debt collection agencies or bailiffs, then you will also need to provide details of this.

The decision of whether to declare you bankrupt will be made by an

Official Adjudicator, normally within 28 days.

The fee for bankruptcy is £680.

Except for business owners, bankruptcies must be applied for individually and cannot be made jointly with a spouse or partner. For credit agreements that have been taken out jointly, if one member of the couple is declared bankrupt, then the other person becomes solely responsible for the debt.

What Process Will I Need to Follow for Bankruptcy?

If you have applied to become bankrupt, then it is important that you prepare and know what is coming.

Official Receiver

Once your case has been approved you will be passed to an Official Receiver. A Receiver is an individual who manages your bankruptcy. You will be required to attend an interview with the Receiver either in person or via telephone. They will take control of your money and assets, deciding which of your assets should be sold for the benefit of the creditors.

Once assets have been sold and your money has been seized, the Receiver then distributes the proceeds to your creditors.

On top of the sale of your assets and the seizing of any savings or windfalls you may have received, the Receiver will decide, based on your disposable income, if you can afford a monthly contribution towards your debt. This is called an Income Payment Order.

Since it is possible that your accounts will be frozen, you will need to open new ones to receive any wages/benefits and to pay for living expenses.

Discharge from Bankruptcy

If the process goes smoothly then you will be discharged from bankruptcy after approximately 12 months. Any relevant remaining debt you have will be written off. It is suggested that, at this stage, you should request an official ‘Letter of Discharge’ as proof.

If the Receiver decided that you should make monthly payments, then these can continue for up to 2 years after the date of discharge.

Once you have been discharged, you can begin to rebuild your credit score, but it is worth noting that it will be negatively affected for six years.

After Bankruptcy

Most of your debts will have been written off, however you may still have some e.g. student loans or court fines.

You could still have a Bankruptcy Restriction Order which can restrict your finances for up to 15 years. This is normally issued if it has been proved that you have knowingly taken on debt you had no intention of paying back, or if you have been uncooperative during the bankruptcy process.

What Happens If I’m Declared Bankrupt?

If your application is successful, then your creditors will no longer be able to contact you or pursue your debt.

You will usually need to sell any high-value assets you may have, to cover as much of the debt as possible. You may also be required to make a monthly payment towards your debt if you earn enough to do so.

Most bankruptcies last for approximately a year and at the end your debts will be written off. It will be entered onto the Public Insolvencies Register and could have a detrimental impact on your future career.

Can I Apply for Bankruptcy If I Own A Business?

Being declared bankrupt can have extremely severe consequences for your business. You should think carefully before proceeding since you may no longer be able to trade.

Self-Employed

Whether you can continue trading as a business owner will be decided by the Receiver. Depending on the circumstances and nature of your business, it could be sold to cover some of your debt relief.

Owner of a PLC

An individual who has been declared bankrupt can no longer hold the position of director in a business. If you are the director or a PLC, then you will need to step down from the position until you have repaid your debts. Once the bankruptcy process is complete you will be unable to manage a Limited Company unless you have sought permission from the court.

What Are the Pros of Bankruptcy?

You will be able to make a fresh start once the process has finished

You will no longer have to deal with your creditors and they can no longer take legal action against you

You will be able to keep any possessions considered essential and you will be able to own a car with up to £1000.

If you are self-employed and your business isn’t to be sold, you can keep any items necessary for your business to continue trading

You may be able to keep your home if there is little or no equity in it.

What Are the Cons of Bankruptcy?

Once the bankruptcy has ended, your credit rating will be affected for a further 6 years.

Your bankruptcy will be put on public record

You could lose your home if it contains equity

You could lose your car if its value exceeds £1,000

You lose the ability to be a director of a limited company

If you are a foreign citizen, then bankruptcy can affect your right to British citizenship.

Where Can I Get Help with My Debt?

If you are considering bankruptcy and are in debt to several companies, it is important for you to seek help or advice. Remember, bankruptcy is a last resort and an IVA may be more suitable for your circumstances. Contact IVA4Me to see if we can help.

Bankruptcy FAQs

Does Going Bankrupt Clear All Debts?

If you are facing bankruptcy, it is essential that you go in to the process with your eyes open to the impact it could have on your future. That includes knowing which debts you may still be facing during the bankruptcy or after it has finished.

Is it Better to go Bankrupt or IVA?

Both bankruptcy and an IVA (Individual Voluntary Arrangement) are forms of insolvency, but they work in different ways. Read on to find out which one might be better for you.

How Much Does Bankruptcy Cost?

This is a question that gets asked a lot and the short answer is that filing for bankruptcy costs £680. For people that are already feeling the effects of financial hardship, this is obviously a lot of money.